From policy and claims management, insurance product configuration and premium collection, to white label distribution with tailored customer journeys – Insurance Software is disrupting the insurance industry. Especially driven by InsurTechs, insurance software innovations are designed to make the current insurance model more efficient, reduce costs and speed up time-to-market. Customers benefit from more convenient digital customer journeys that reduce or even fully replace human interaction. As a result, staff costs decrease, conversions increase and increased policy sales grow revenue.

In this article, we will look at insurance software based on Boston Consulting Group’s research on current digital trends affecting the insurance industry and the Briisk ITP insurance software, which is build upon these insights.

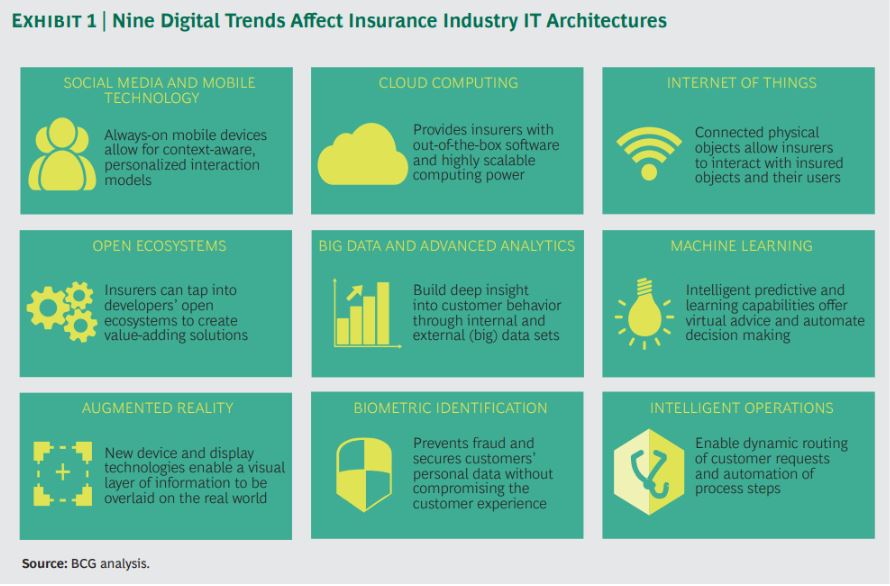

Nine digital trends affecting Insurance Software architectures

According to the Boston Consulting Group, there are nine technology trends affecting the IT architecture in insurance: Social media and mobile technology, cloud computing, IoT, open ecosystems (also known as “open insurance”), big data, machine learning, augmented reality, biometric identification and intelligent operations. At Briisk, we apply these digital trends to design our insurance software solution (find out more about Briisk here). BCG concludes, that the combination of these technological components affect the entire insurance software landscape, leading many insurers “to go beyond building digital channel functionality and undertake an integrated front-to-back overhaul of the IT landscape” (BCG 2016). Let’s have a look at how to use these trends in practice.

Want to learn more about digital trends in the insurance industry? Have a look at “Digital transformation in Insurance – Essential Insurance technology you need to know”

So how can these trends be used in practice for Insurance Software?

Efficient and effective distribution via white labels

There is a growing demand by insurance players for customer engagement and integration layers. Thus, located in the customer engagement layer, we focus on web and portals and third party channels as key components of insurance software solutions. As a result, we empower the insurance value chain to meet the demand for efficient and effective insurance distribution. In practice, this is achieved by insurance distribution via white label, multiple distribution channels and fully-responsive and conversion-optimised customer journeys.

Are you interested in insurance distribution via white labels? Get a demo or have a look at our drone insurance white label case study

Scale via cloud computing

A clearly evident trend which does not only apply to the insurance industry, is cloud computing. According to BCG, cloud-based insurance software allows for “scalable high-performance digital services and rapid time to market […] Cloud solutions replace on-premises legacy systems that depend on (expensive) self-owned data centers and a central team to manage the IT infrastructure and provide IT services.” The scalability will manifest itself in the near future particularly in the Briisk ITP through so-called “distribution networks”: Every time a new distribution channel is onboarded, they will become usable for all players so that a network effect occurs.

Innovating core insurance system functionality

Another insight is that the creation of new insurance products is often code-heavy, labour-intensive and expensive. Launching new products often takes many months. To solve this pain point, the Briisk ITP specialises in the core insurance system layer on simple product configuration. Quote, underwrite and bind is available on one platform, the product builder is intuitive and highly flexible and programming complexity is minimized. As a result, new insurance products can be launched in not months, not days, but hours.

Does that sound too ambitious to you? See how we launched the first COVID-19 insurance in South Africa in just 3 hours!

Sources:

https://image-src.bcg.com/Images/BCG-Building-a-Digital-Technology-Foundation-in-Insurance-Aug-2016_tcm9-63056.pdf